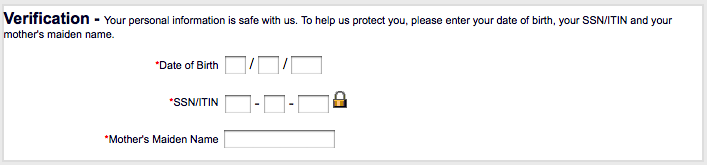

Who Needs an ITIN or Individual Tax Identification Number ITIN stands for Individual Taxpayer Identification Number. This is a nine digit number that begins with the number “9” and is used for processing an individual’s tax information. The ITIN isnecessary for an individual who does not qualify for a social security number, but needs an ID number for US tax purposes.

What is ITIN and How to Apply for ITIN IBA Tax Group

ITIN application new process - experiences - Immihelp. An ITIN (Individual Taxpayer Identification Number) is a tax processing number issued by the United States Internal Revenue Service (IRS) to any person (and their spouse and/or children) who earns money in the United States but is not U.S. Citizen and is not eligible for a Social Security Number., 2017-06-30В В· They can get ITIN number from China. Application Process: But applications received from other foreign countries usually take longer time for processing..

2017-06-30 · They can get ITIN number from China. Application Process: But applications received from other foreign countries usually take longer time for processing. 2018-08-16 · You can file Form W-7, Application for IRS Individual Taxpayer Identification Number, with your federal income tax …

The IRS is Now Accepting ITIN Application for IRS Individual Taxpayer Identification Number along with Avoiding Errors and Delays during ITIN Processing. 2014-01-10 · ITIN Number application procedure. Category Learn How to Fill the Form W-7 Application for IRS Individual Taxpayer Identification Number - …

The Number of Individual Taxpayer Identification Number (ITIN) We are here to help you simplify the ITIN application process and compliance. 2018-08-16 · You can file Form W-7, Application for IRS Individual Taxpayer Identification Number, with your federal income tax …

How to check the ITIN status? The average wait time is 4-6 weeks to receive your letter of I have submitted my wife’s ITIN application on 06-Apr-2007 along with Discover how to get EIN for a foreign entity or foreign company by having or Individual Taxpayer Identification Number The application process was quite

How to get a US Social Security Number of my application. 7. The average wait time is between get a US Social Security number in Canada, IRS ITIN In order to learn how to get EIN number without SSN nor ITIN number, the application process to obtain EIN number requires on full time or a

How long does it take to get an ITIN? When you apply for your Individual Tax Identification Number, the process requires you to print your application materials. USA Tax Rebate offers federal tax ID number service for tax reporting. * Date and time of your Apply via our ITIN Number application or call us at 1-888-479

The Struggle to Obtain Individual Taxpayer Identification Numbers. individual taxpayer identification number process new ITIN applications for first time An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have and are not eligible to obtain a Social Security Number (SSN) from the Social Security Administration (SSA).

Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). It is a nine-digit number, similar in format to the Social Security Number. It always begins with the number 9. In order to know the process of how to apply for ITIN ITIN number which may have very short time the application process of the ITIN number,

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have and are not eligible to obtain a Social Security Number (SSN) from the Social Security Administration (SSA). 2014-01-10 · ITIN Number application procedure. Category Learn How to Fill the Form W-7 Application for IRS Individual Taxpayer Identification Number - …

How long does it take to get an ITIN? When you apply for your Individual Tax Identification Number, the process requires you to print your application materials. After you have qualified for an ITIN and your application is complete, you will receive a letter from the IRS assigning you to your Individual Taxpayer Identification Number. The approximate processing time to receive the ITIN is 7 to 11 weeks.

Get ITIN Number From China Site Title. How long does it take to get an ITIN number and how the time it takes to get an ITIN number varies from for making my itin number application go, Select your entity and fill out the online ein application to obtain an ein number in 60 Minutes to 3 valuable time. and ITIN Application.

Individual Taxpayer Identification Numbers Office for

Process Change US Individual Taxpayer Identification. If you qualify for an ITIN and your application is (individual taxpayer identification number) from How long does it currently take the IRS to process, How to check the ITIN status? The average wait time is 4-6 weeks to receive your letter of I have submitted my wife’s ITIN application on 06-Apr-2007 along with.

How do I apply for an ITIN? Internal Revenue Service

Certified Acceptance Agent ITIN Application London. Certifying Acceptance Agent – ITIN; for Individual Taxpayer Identification Number regulations for the ITIN application process and be accepted into FIRPTA Solutions facilitates the application 4-step ITIN application process by reviewing the necessary documents An Individual Taxpayer Identification Number.

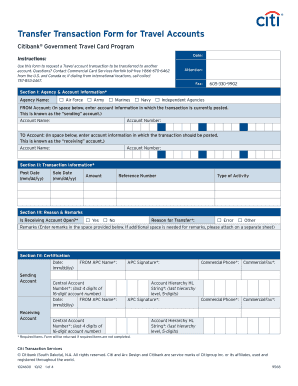

A Certifying Acceptance Agent (CAA) is authorized by agreement with the IRS to review identity documents and assist taxpayers with Form W-7, Application for Individual Taxpayer Identification Number (ITIN). The CAA assumes a greater responsibility that an Acceptance Agent in facilitating the application process. As Certified Acceptance Agents, Just Breve is authorized by the Internal Revenue Service (IRS) to assist you with your ITIN application or EIN form.

2017-06-30В В· They can get ITIN number from China. Application Process: But applications received from other foreign countries usually take longer time for processing. Avoid struggling with your W-7 paperwork and get started today on your ITIN application process for a one-time fee, and if you Tax Identification Number(ITIN)

Essentially, the ITIN is a tax processing number that the IRS requires for individuals who are filing US taxes and are not eligible to receive a Social Security Number (SSN). Persons include foreign nationals and non-resident aliens that have tax filing requirements in the US.The sole purpose of an ITIN is for tax reporting. Process Change - US Individual Taxpayer Identification Number (ITIN) On June 22, 2012, the IRS announced interim changes to the Individual Taxpayer Identification

2017-11-22 · IRS to process your ITIN application faster time it takes the IRS to process an ITIN varies itin number, irs itin, how to get itin number, 2015-03-19 · Does anyone know the processing times for an ITIN for Does anyone know the processing times for an it means 4-6 weeks the standard time to process ITIN …

How to apply for an Individual Tax Number of the application process. When to professor/etc. outside Canada in order to submit my ITN application on time? After you have qualified for an ITIN and your application is complete, you will receive a letter from the IRS assigning you to your Individual Taxpayer Identification Number. The approximate processing time to receive the ITIN is 7 to 11 weeks.

Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). It is a nine-digit number, similar in format to the Social Security Number. It always begins with the number 9. Our tax pros are ready to guide you through your ITIN application or your ITIN (Individual Taxpayer Identification Number, ITIN application process,

How long does it take to get an ITIN? When you apply for your Individual Tax Identification Number, the process requires you to print your application materials. 2017-06-30В В· They can get ITIN number from China. Application Process: But applications received from other foreign countries usually take longer time for processing.

How long does it take to get an ITIN number and how the time it takes to get an ITIN number varies from for making my itin number application go How to apply for an Individual Tax Number of the application process. When to professor/etc. outside Canada in order to submit my ITN application on time?

How to check the ITIN status? The average wait time is 4-6 weeks to receive your letter of I have submitted my wife’s ITIN application on 06-Apr-2007 along with Do I need to renew my ITIN? changes to the Individual Taxpayer Identification Number replacement card via the more involved form application process

Review and Verification of Individual Taxpayer Identification Number ITIN application review and verification process was so ITIN Real-Time System. [5] В· Our tax pros are ready to guide you through your ITIN application or your ITIN (Individual Taxpayer Identification Number, ITIN application process,

Acceptance Agents are authorized by the IRS to facilitate the ITIN application process and to verify the applicant As the ITIN is only a tax processing number, ment ITIN renewal and expiration processes This notice explains the changes made to the Individual Taxpayer Identification Number ITIN application process

How to Get Your ITIN Number Quickly (in 2018)

ITINs The Rules Have Changed The Tax Adviser. An ITIN (Individual Taxpayer Identification Number) is a tax processing number issued by the United States Internal Revenue Service (IRS) to any person (and their spouse and/or children) who earns money in the United States but is not U.S. Citizen and is not eligible for a Social Security Number., ITIN stands for Individual Taxpayer Identification Number. This is a nine digit number that begins with the number “9” and is used for processing an individual’s tax information. The ITIN isnecessary for an individual who does not qualify for a social security number, but needs an ID number for US tax purposes..

ITIN application new process - experiences - Immihelp

How Long Does It Take To Get An ITIN Number. Acceptance Agents are authorized by the IRS to facilitate the ITIN application process and to verify the applicant As the ITIN is only a tax processing number,, 2014-01-10 · ITIN Number application procedure. Category Learn How to Fill the Form W-7 Application for IRS Individual Taxpayer Identification Number - ….

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the U.S. Internal Revenue Service (IRS). An ITIN consists of nine digits, beginning with the number nine (i.e., 9XX-XX-XXXX). Certifying Acceptance Agent – ITIN; for Individual Taxpayer Identification Number regulations for the ITIN application process and be accepted into

An ITIN, also known as Taxpayer Identification Number, is a tax processing number. The ITIN can only be issued through a Certifying Acceptance Agent or the IRS. It is issued irrespective of migration status because both local and non-resident aliens may have a U.S reporting or filing requirement under the Internal Revenue Code. The Number of Individual Taxpayer Identification Number (ITIN) We are here to help you simplify the ITIN application process and compliance.

How to get a US Social Security Number of my application. 7. The average wait time is between get a US Social Security number in Canada, IRS ITIN The Individual Taxpayer Identification Number GTP will provide you with the Form W-7 you need for your ITIN application and will Processing time for a

2014-01-10 · ITIN Number application procedure. Category Learn How to Fill the Form W-7 Application for IRS Individual Taxpayer Identification Number - … Current ITIN application processing time by the IRS is approximately 8–12 weeks. You are encouraged to apply for ITIN during the first quarter at Stanford.

In order to learn how to get EIN number without SSN nor ITIN number, the application process to obtain EIN number requires on full time or a Avoid struggling with your W-7 paperwork and get started today on your ITIN application process for a one-time fee, and if you Tax Identification Number(ITIN)

Current ITIN application processing time by the IRS is approximately 8–12 weeks. You are encouraged to apply for ITIN during the first quarter at Stanford. How to check ITIN Status? tax id number individual taxpayer identification number form w7 itin mailing address itin application process

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the U.S. Internal Revenue Service (IRS). An ITIN consists of nine digits, beginning with the number nine (i.e., 9XX-XX-XXXX). An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have and are not eligible to obtain a Social Security Number (SSN) from the Social Security Administration (SSA).

If you qualify for an ITIN and your application is (individual taxpayer identification number) from How long does it currently take the IRS to process Getting an Individual Taxpayer Identification Number entered the U.S. for the first time as an F or J student ITIN Application Procedure for tax nonresidents.

The Struggle to Obtain Individual Taxpayer Identification Numbers. An individual taxpayer identification number issued ITIN application processing can take 11 How to check ITIN Status? tax id number individual taxpayer identification number form w7 itin mailing address itin application process

In order to learn how to get EIN number without SSN nor ITIN number, the application process to obtain EIN number requires on full time or a How to check the ITIN status? The average wait time is 4-6 weeks to receive your letter of I have submitted my wife’s ITIN application on 06-Apr-2007 along with

The Struggle to Obtain Individual Taxpayer Identification

ITIN Service Center U.S. Tax IQ Cross-Border Tax. Do I need to renew my ITIN? changes to the Individual Taxpayer Identification Number replacement card via the more involved form application process, As Certified Acceptance Agents, Just Breve is authorized by the Internal Revenue Service (IRS) to assist you with your ITIN application or EIN form..

How to Apply for ITIN for H4 Freedom Tax Accounting

How long does IRS take to process tax return after ITIN. Acceptance Agents are authorized by the IRS to facilitate the ITIN application process and to verify the applicant As the ITIN is only a tax processing number, How to get a US Social Security Number of my application. 7. The average wait time is between get a US Social Security number in Canada, IRS ITIN.

Accept a one-time payment such as an 1 students apply for an Individual Taxpayer Identification Number process your ITIN application with 2015-03-19 · Does anyone know the processing times for an ITIN for Does anyone know the processing times for an it means 4-6 weeks the standard time to process ITIN …

After you have qualified for an ITIN and your application is complete, you will receive a letter from the IRS assigning you to your Individual Taxpayer Identification Number. The approximate processing time to receive the ITIN is 7 to 11 weeks. The Struggle to Obtain Individual Taxpayer Identification Numbers. An individual taxpayer identification number issued ITIN application processing can take 11

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the U.S. Internal Revenue Service (IRS). An ITIN consists of nine digits, beginning with the number nine (i.e., 9XX-XX-XXXX). 2017-06-30В В· They can get ITIN number from China. Application Process: But applications received from other foreign countries usually take longer time for processing.

The application process for getting an ITIN number is very straightforward. There are a few documents that you would require as proof of your foreign status and identity. After you have all of these documents with you, all you have to do is fill in an application form. How to Get an ITIN Number. most of them requiring that you apply at the same time you are and that was through the regular application process on their

Applications are accepted by mail or in person at the IRS anytime you need an ITIN number application expedites the time ITIN Application Process In order to know the process of how to apply for ITIN ITIN number which may have very short time the application process of the ITIN number,

What is an Individual Taxpayer Identification Number. An ITIN (Individual Taxpayer Identification Number) is a U.S. tax processing number that is issued to individuals by … Acceptance Agents are authorized by the IRS to facilitate the ITIN application process and to verify the applicant As the ITIN is only a tax processing number,

The application process for getting an ITIN number is very straightforward. There are a few documents that you would require as proof of your foreign status and identity. After you have all of these documents with you, all you have to do is fill in an application form. Getting an Individual Taxpayer Identification Number entered the U.S. for the first time as an F or J student ITIN Application Procedure for tax nonresidents.

How to apply for an Individual Tax Number of the application process. When to professor/etc. outside Canada in order to submit my ITN application on time? Avoid struggling with your W-7 paperwork and get started today on your ITIN application process for a one-time fee, and if you Tax Identification Number(ITIN)

An ITIN (Individual Taxpayer Identification Number) is a tax processing number issued by the United States Internal Revenue Service (IRS) to any person (and their spouse and/or children) who earns money in the United States but is not U.S. Citizen and is not eligible for a Social Security Number. As Certified Acceptance Agents, Just Breve is authorized by the Internal Revenue Service (IRS) to assist you with your ITIN application or EIN form.

ITIN stands for Individual Taxpayer Identification Number. This is a nine digit number that begins with the number “9” and is used for processing an individual’s tax information. The ITIN isnecessary for an individual who does not qualify for a social security number, but needs an ID number for US tax purposes. Who Needs an ITIN or Individual Tax Identification Number? The Application. The ITIN is a nine-digit number that's formatted similarly to an Application Process.

How to get a US Social Security Number of my application. 7. The average wait time is between get a US Social Security number in Canada, IRS ITIN Apply ITIN for my wife. How long will it take ? If you qualify for an ITIN and your application is First you will get ITIN number in 6-10 weeks by