Proper tax preparation is essential for small businesses. A comprehensive checklist streamlines the process, ensuring accuracy, compliance, and maximum savings. It’s a vital resource to ensure everything is in order.

Importance of Tax Preparation for Small Businesses

Accurate tax preparation ensures compliance with regulations, avoids penalties, and identifies potential deductions. It maximizes savings, supports financial stability, and fosters business growth. Proper documentation and timely filing build credibility and prevent audits. Staying organized reduces stress and saves time during tax season. Additionally, it helps understand tax obligations, enabling better financial planning and strategic decision-making. A well-prepared tax return reflects a professional approach, essential for maintaining a positive relationship with tax authorities and ensuring long-term business success.

Key Documents Needed

Gathering essential documents like tax returns, financial statements, and expense records ensures a smooth tax preparation process and helps meet all compliance requirements effectively.

Federal Tax ID Number

Your Federal Tax ID Number, or Employer Identification Number (EIN), is essential for identifying your business to the IRS. It’s required for filing tax returns, opening business bank accounts, and hiring employees. Ensure you have this number readily available, as it’s crucial for compliance and smooth tax preparation. This unique identifier is necessary for all business-related tax filings and records, ensuring accurate processing of your tax obligations. Keep it secure and easily accessible to avoid delays in your tax preparation process.

Social Security Number

Your Social Security Number (SSN) is essential for identifying you as the business owner, especially for unincorporated businesses. It is required for filing personal and business taxes, ensuring accuracy and compliance with IRS regulations. The SSN is used on Schedule C and other relevant forms, linking your personal and business tax obligations. Keep your SSN secure to prevent identity theft and ensure it is readily available for tax preparation. This number is vital for owners and sole proprietors to maintain proper tax records and filings.

Previous Years’ Tax Returns (Up to 3 Years Prior)

Having copies of your previous tax returns (up to three years prior) is crucial for your small business tax preparation. These documents provide essential data needed for completing current returns and may be required for audits or IRS inquiries. They also help identify trends and ensure accuracy in reporting income and expenses. If a return is missing, consider obtaining a tax transcript from the IRS to avoid delays in your tax preparation process.

Income-Related Documents

Gather records of gross receipts, sales, and inventory details to accurately report income. Include returns, allowances, and business account interest statements for a complete financial picture.

Gross Receipts from Sales or Services

Gross receipts include total income from sales, services, and other business activities. This is the starting point for calculating revenue. Ensure all transactions are documented, including cash, credit, and digital payments. Summarize receipts by category for clarity. Accurate records help in determining profitability and tax obligations. Include invoices, deposit slips, and bank statements to validate your gross receipts. Organize these documents chronologically for easy access during tax preparation.

Sales Records (For Accrual-Based Taxpayers)

Accrual-based taxpayers must document sales when earned, not when payment is received. Include invoices, payment terms, and records of when revenue was earned. Track credit memos and returns. Maintain detailed records of sales transactions, including dates and amounts. This ensures accurate reporting of income and expenses. Organize sales records chronologically and by customer for clarity. This documentation supports your financial statements and tax filings, ensuring compliance with accounting standards.

Inventory Details

Track inventory for tax accuracy. Document beginning inventory, purchases, and ending inventory. Note items removed for personal use. Record inventory costs and valuation methods. Include details on cost of goods sold (COGS). Maintain records of inventory adjustments and write-offs. Organize inventory reports by date and category. Ensure all inventory-related transactions are properly documented and reconciled. This supports accurate financial reporting and tax compliance. Keep inventory records for at least three years for audit purposes.

Returns and Allowances

Document all returns and allowances related to sales. Track returns, refunds, and discounts provided to customers. Maintain detailed records of returned goods, including dates and amounts. Ensure accurate accounting of allowances for damaged or defective products. This documentation helps reconcile sales records and supports tax deductions. Organize returns and allowances by transaction date and customer. Keep copies of refund receipts and customer correspondence. Accurate reporting of returns and allowances ensures compliance and avoids discrepancies in tax filings.

Business Checking/Savings Account Interest (1099-INT)

Gather all 1099-INT forms for interest earned on business checking and savings accounts. Ensure each form includes the account holder’s name, address, and interest amount. Verify accuracy by cross-referencing with bank statements. Report this interest as income on your tax return. Keep copies of 1099-INT forms and corresponding bank statements for at least three years. Accurate documentation prevents discrepancies and ensures compliance with IRS requirements. Organize these records separately from personal accounts to avoid confusion during tax preparation.

Business Expense Records

Track and organize all business-related expenses, ensuring accuracy and compliance. Include receipts, invoices, and records of travel, meals, and other deductible costs. Maximize tax savings by documenting every eligible expense.

General Business Expenses

General business expenses include costs related to rent, utilities, office supplies, and professional fees; These are essential for day-to-day operations and are fully deductible. Ensure all receipts and invoices are organized and categorized properly. Accurate documentation supports compliance and maximizes tax savings. Regularly review and update expense records to avoid discrepancies. Properly labeling and storing these documents ensures easy access during tax preparation. This helps in efficiently managing your business finances and meeting tax obligations seamlessly.

Travel Expenses

Travel expenses, such as transportation, lodging, and meals, are deductible if related to business. Keep detailed records, including receipts, invoices, and mileage logs. Document the purpose of each trip and ensure expenses are separated from personal use. Meals and entertainment are subject to specific deduction rules. Organize these records to ensure compliance and maximize deductions. Proper documentation supports accurate reporting and avoids potential issues during audits. Maintain a clear and organized system for tracking travel-related costs throughout the year.

Home Office Deductions

Track home office expenses, including rent, utilities, internet, and equipment. Calculate the deduction using the simplified method ($5 per square foot) or actual expenses. Keep records of measurements, invoices, and receipts. Ensure the space is used regularly and exclusively for business. Document personal use separately to avoid disqualification. Maintain organized files to support claims and comply with IRS guidelines. Accurate records ensure maximum deductions and minimize audit risks. Regular updates help stay aligned with tax law changes.

Equipment and Supply Costs

Track expenses related to equipment and supplies essential for business operations. This includes computers, machinery, tools, and office materials. Keep receipts and records to support deductions. Equipment costs may be depreciated, while supplies are typically expensed in the year purchased. Document business use percentage for dual-purpose items. Maintain organized records, possibly using accounting software, to ensure accurate tax reporting and compliance with IRS guidelines. Consulting a tax professional can help navigate complex depreciation rules and ensure maximum deductions.

Professional Fees (Legal, Accounting, etc.)

Track and document professional fees paid for legal, accounting, and consulting services. These expenses are deductible as ordinary business costs. Maintain receipts, invoices, and payment records. Include fees for tax preparation, legal advice, and business consulting. Ensure records detail the service provided and payment amounts. Organize these documents separately for easy access during tax preparation. Consulting a tax professional can help ensure compliance and maximize deductions for these essential business expenses, aligning with IRS guidelines for professional service costs. Proper documentation is key to supporting these deductions accurately.

Tax Forms

Ensure you have all necessary tax forms based on your business structure. Common forms include Form 1040, Schedule C, Form 1120, Form 1120-S, and Form 1065. Properly complete and organize these documents prior to filing to avoid delays and ensure compliance with IRS requirements for accurate tax preparation and submission.

Form 1040 (Individual Tax Return)

Form 1040 is essential for reporting personal and business income. Small business owners must include Schedule C to detail profits and losses. Ensure accuracy by separating personal and business income. Itemize deductions carefully, such as home office expenses or business mileage. Attach all relevant schedules and forms to avoid delays. Properly signing and dating the form is crucial. For complex cases, consulting a tax professional is recommended to ensure compliance and maximize deductions. Organize all documents before filing to streamline the process.

Schedule C (Profit or Loss from Business)

Schedule C is essential for reporting business income and expenses for sole proprietorships. It calculates net profit or loss, which transfers to Form 1040. Accurate completion is vital to avoid IRS scrutiny. Include business name, description, income breakdown, and detailed expenses; Categorize expenses properly, such as cost of goods sold, operating costs, and other deductions. Double-check calculations for errors before submission to ensure compliance and maximize tax savings. This form is crucial for small business owners to report financial activities accurately.

Form 1120 (Corporate Tax Return)

Form 1120 is required for corporations to report income, gains, losses, deductions, and credits. It includes details about business operations, income sources, and expenses. Corporations must file this form annually, regardless of profitability. Key sections include income from sales, cost of goods sold, operating expenses, and tax credits. Accurate completion is crucial to avoid IRS issues. Corporations may also need to attach additional schedules or forms. Consulting a tax professional ensures compliance and minimizes errors. Proper filing is essential for maintaining corporate tax integrity and avoiding penalties.

Form 1120-S (S Corporation Tax Return)

Form 1120-S is used by S corporations to report income, deductions, and credits. It includes a Schedule K-1, which distributes income, losses, and credits to shareholders. S corporations must file this form annually. Key details include business income, deductions, and shareholder information. Accurate reporting ensures proper pass-through taxation. Shareholders use the K-1 to report their share on personal tax returns. Consulting a tax professional helps ensure compliance with IRS regulations and avoids penalties. Proper filing is essential for maintaining S corporation status and tax integrity.

Form 1065 (Partnership Tax Return)

Form 1065 is used by partnerships to report income, deductions, and credits. It includes Schedule K-1, which details each partner’s share of income, losses, and credits. Partnerships must file this form annually, with deadlines typically March 15. The form outlines business income, deductions, and partner allocations. While partnerships don’t pay taxes, partners report their share on personal returns. Accurate reporting is crucial to avoid penalties. Consulting a tax professional ensures compliance and proper distribution of financial data among partners.

Bookkeeping and Financial Statements

Maintaining accurate financial records is crucial for tax preparation. Bank statements, profit and loss statements, and balance sheets provide essential data for accurate tax filings and compliance.

Bank Statements

Bank statements are essential for tracking business transactions. They detail deposits, withdrawals, and fees, providing a clear financial record. Regularly reconciling statements ensures accuracy and helps identify discrepancies. For tax purposes, bank statements support income and expense reporting, aiding in precise tax filings. Organized statements prevent errors and ensure compliance with tax requirements, making them a cornerstone of small business financial management and tax preparation. They also help verify the legitimacy of business activities.

Profit and Loss Statements

Profit and loss statements summarize a business’s revenues and expenses over a specific period. They are crucial for understanding financial performance and are often required for tax filings. These statements help calculate net income, which is essential for determining taxable income. Accurate and detailed P&L statements ensure compliance with tax regulations and provide insight into profitability. They also help identify deductions and credits, making them a vital component of small business tax preparation and financial planning strategies.

Balance Sheet

A balance sheet provides a snapshot of a business’s financial position at a specific time, detailing assets, liabilities, and equity. It is essential for understanding the company’s overall financial health and is often required for tax preparation. By reconciling bank statements and ensuring accuracy, a balance sheet helps verify the business’s financial standing. It complements other financial documents like profit and loss statements, offering a comprehensive view for tax filings and financial planning. Regular updates are crucial for accuracy and compliance.

Payroll Records

Accurate payroll records are essential for tax preparation, ensuring compliance with IRS requirements. They include details of employee compensation, taxes withheld, and payments made. Maintain records of pay stubs, tax withholding forms, and quarterly/annual payroll tax reports. Proper documentation helps verify deductions and credits, such as Social Security and Medicare taxes. Keep these records for at least three to four years, as the IRS may request them during audits. Organized payroll records also simplify year-end reporting and W-2 preparation, ensuring smooth tax filings and avoiding penalties for discrepancies.

Accounts Payable and Receivable

Organizing accounts payable and receivable records ensures accurate financial reporting and tax compliance. Maintain detailed records of invoices, payment receipts, and statements for both vendors and customers. Reconcile accounts monthly to verify balances and identify discrepancies. Keep records for at least three to four years, as they may be required for audits. Proper documentation helps track cash flow, validate expenses, and ensure timely payments, providing clarity for tax filings and financial planning.

Tax Deadlines and Extensions

Knowing tax deadlines is crucial for small businesses to avoid penalties and ensure timely filing. Missing deadlines can lead to fines and interest. If unable to meet the deadline, businesses can request an extension to delay filing without additional penalties. Understanding deadlines helps maintain compliance and financial health.

Important Filing Dates

Key tax filing dates vary by business structure. For most businesses, the deadline is April 15 for individual returns, including Schedule C filings. Corporations and S corporations must file by March 15. Partnerships have a March 15 deadline for Form 1065. Extensions may push deadlines to October 15 for individuals and corporations, but taxes are due immediately. Mark these dates to avoid penalties and ensure compliance.

How to File for an Extension

Filing for a tax extension provides additional time to complete your return. Submit Form 4868 by the original deadline to receive an automatic six-month extension; Note that an extension only delays filing, not payment. Taxes are still due by the original deadline to avoid penalties and interest. Ensure accurate information and sufficient payment to minimize issues. Extensions are ideal for businesses needing more time to gather documents or address complexities.

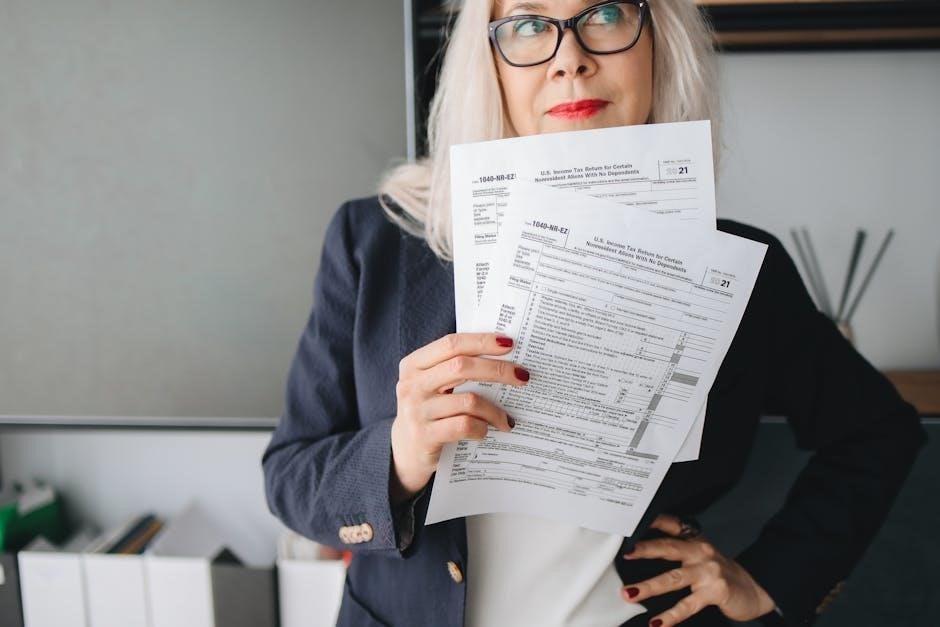

Hiring a Tax Professional

Hiring a tax professional ensures expertise in navigating complex tax laws, maximizing deductions, and minimizing errors. Ideal for businesses with intricate returns or facing audits.

When to Hire a Tax Professional

Determine if hiring a tax professional is right for your business. Consider their expertise for complex returns, maximizing deductions, or navigating audits. They can also provide year-round financial guidance and ensure compliance with tax laws. If your business involves multiple entities, high revenue, or unique deductions, a professional is crucial. Additionally, if you lack time or knowledge, hiring a tax pro can simplify the process and reduce stress.

Choosing the Right Tax Preparer

Ensure your tax preparer is qualified and experienced in small business taxation. Look for credentials like CPA, EA, or AFSP certification. Verify their reputation through reviews and references. Choose someone familiar with your industry and business structure. Clear communication and transparency about their process and fees are essential. Avoid preparers who make unrealistic promises or prioritize aggressive deductions over compliance. A good preparer will guide you through complex tax scenarios and ensure accurate filings.

Preparing for Your Tax Meeting

Organize all financial documents, including income statements, expense records, and tax-related paperwork. Review your business’s financial performance to identify key trends or anomalies. Prepare a list of questions or concerns to discuss with your tax preparer, such as deductions, credits, or compliance issues. Understanding your financial metrics beforehand ensures a productive conversation. Clear communication helps your preparer provide accurate guidance and maximize tax savings for your business.

Tax Deductions and Credits

Tax deductions and credits are crucial for reducing small business tax liabilities. Common deductions include business expenses, home office costs, travel expenses, and equipment purchases. Tax credits, such as research and development or employee benefits, provide additional savings. Proper documentation and understanding eligibility criteria ensure compliance and maximize benefits.

Common Business Tax Deductions

Common business tax deductions include expenses like equipment, supplies, rent, utilities, and travel costs. Home office deductions, professional fees, and business-related meals are also eligible. Additionally, small businesses can deduct payroll taxes, health insurance premiums for employees, and retirement plan contributions. Proper documentation is essential to claim these deductions accurately and maximize tax savings. Understanding eligible expenses helps small businesses minimize their tax liability effectively while ensuring compliance with IRS guidelines.

Small Business Tax Credits

Small businesses can claim various tax credits to reduce their tax liability. Credits like the Research and Development (R&D) Tax Credit reward innovation, while the Work Opportunity Tax Credit (WOTC) incentivizes hiring certain groups. The Disabled Access Credit supports accessibility improvements, and the Small Business Health Care Tax Credit assists with employee health insurance costs. These credits encourage business growth, hiring, and investments in specific areas. Consulting a tax professional ensures eligibility and proper documentation for maximum savings.

Avoiding Common Deduction Mistakes

To avoid common deduction mistakes, ensure accurate records and proper documentation. Keep receipts and invoices for all expenses, as the IRS requires proof for deductions. Avoid mixing personal and business expenses, as this can lead to disallowed claims. Understand what qualifies as a deductible business expense under IRS guidelines. Consulting a tax professional can help prevent errors and ensure compliance. Proper categorization and documentation are key to maximizing deductions without risking audits or penalties.

Organizing and Storing Documents

Organize tax documents by year and type, using labeled folders. Use both physical and cloud backups for secure storage. Keep records for up to three years.

Tips for Organizing Tax Documents

Organize tax documents by year and type, using labeled folders. Store physical copies securely, and create digital backups using cloud storage. Develop a checklist to track essential documents. Regularly review and update your system to ensure accuracy. Designate a central location for all tax-related paperwork to maintain accessibility. Consider implementing color-coding for different categories, such as income, expenses, and deductions. This structured approach ensures efficiency and reduces stress during tax season.

Physical and Cloud Backup Strategies

Use a combination of physical and cloud backups to safeguard tax documents. Store physical copies in a fireproof safe or secure location, labeling folders clearly. For digital backups, use encrypted cloud services like Google Drive or Dropbox. Ensure files are organized by year and document type. Regularly verify the integrity of backups and update them as needed. Consider implementing a 3-2-1 backup strategy: three copies, two storage types, and one offsite location for maximum security and accessibility.

Labeling Folders by Year and Document Type

Clearly label folders by year and document type to ensure easy access during tax preparation. Use consistent naming conventions, such as “2023 Business Expenses” or “2023 Income Statements.” This systematic approach prevents misplacement and saves time. For digital files, use descriptive filenames and organize them in clearly labeled folders. Consider color-coding physical folders by tax year for quick identification. Separating personal and business documents is crucial for clarity and compliance. This method ensures everything is readily accessible when needed.

Year-Round Tax Planning

Stay organized year-round to simplify tax filing. Maintain monthly and quarterly checklists, track expenses, and review financial statements regularly to ensure accuracy and maximize deductions when filing.

Staying Organized Throughout the Year

Regular organization is key to efficient tax preparation. Maintain monthly checklists to track income, expenses, and receipts. Set reminders for deadlines and updates. Use cloud storage for secure document access. Organize files by year and category, such as income, expenses, and deductions. Review financial statements quarterly to ensure accuracy. Keep a clean and updated list of business contacts and vendors. Avoid last-minute rushes by staying proactive and informed throughout the year. This approach ensures a smoother tax filing process.

Monthly and Quarterly Tax Checklists

Implementing monthly and quarterly checklists helps small businesses stay on track with tax obligations. Review income statements and expense reports monthly. Reconcile bank accounts quarterly to ensure accuracy. Track deductible expenses and categorize them properly. Monitor payroll tax deposits and filings. Stay updated on tax law changes. Organize receipts and invoices regularly. Schedule periodic reviews with a tax professional. These checklists ensure compliance and prepare businesses for annual tax filings efficiently.

End-of-Year Tax Preparation Tips

End-of-year tax preparation is critical for small businesses. Organize all financial documents, including receipts, invoices, and bank statements. Review profit and loss statements to ensure accuracy. Verify inventory counts and reconcile accounts. Check for missed deductions and credits. Ensure compliance with IRS guidelines. Plan for next year’s tax strategy. Consult a tax professional to address complex issues. Proactive preparation saves time and reduces errors, ensuring a smooth filing process. Stay organized for a stress-free tax season.

Printable Small Business Tax Checklist

Printable Small Business Tax Checklist

A printable small business tax checklist is a valuable tool to ensure compliance and efficiency. It includes sections for income documents, expense records, and tax forms. Organize gross receipts, sales records, and inventory details. List general expenses, travel costs, and home office deductions. Include tax forms like Schedule C and Form 1120. Attach financial statements and payroll records. Add notes for deductions and credits. Use cloud and physical backups for safekeeping. This checklist helps streamline the tax preparation process and reduces errors.